reader comments

72 with 46 posters participating

Last week, US senators and representatives introduced bills in the Senate and the House to open up a type of corporate structure originally reserved for oil, gas, and coal companies to clean energy companies.

Called a Master Limited Partnership (MLP), the structure currently allows fossil fuel companies to take advantage of lower taxes placed on limited partnerships while also allowing those companies to issue publicly traded stocks and bonds. If the recently re-introduced bills—which have bipartisan support in both the House and the Senate—pass their respective votes, clean energy companies would have the option to structure their companies as MLPs and take advantage of the tax and funding benefits.

According to sponsoring Senator Chris Coons’ (D-Del.) website, “Newly eligible energy resources would include solar, wind, marine and hydrokinetic energy, fuel cells, energy storage, combined heat and power, biomass, waste heat to power, renewable fuels, biorefineries, energy-efficient buildings, and carbon capture, utilization, and storage (CCUS).”

MLP structuring is among the many incentives that fossil fuel companies can take advantage of to make their businesses more profitable. In 2017, a paper in Nature Energy counted an annual $2 billion in federal and state tax breaks that went to stimulating domestic oil production.

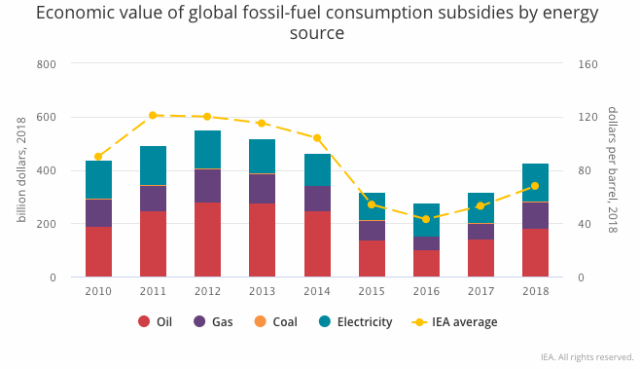

The International Energy Agency (IEA) also recently shined a spotlight on fossil fuel subsidies on a global scale. Last week, the agency released a report saying that despite some headway made in recent years, the global value of fossil fuel subsidies increased back to 2014 levels in 2018, “underscoring the incomplete nature of the pricing reforms undertaken in recent years.” The value of fossil fuel subsidies increased in 2018 to nearly $400 billion globally.

Fossil fuel subsidies are inefficient in developed countries because they keep the price of carbon dioxide-emitting energy unnaturally low. “The continued prevalence of these subsidies—more than double the estimated subsidies to renewables—greatly complicates the task of achieving an early peak in global emissions,” the IEA wrote.

Unfortunately, removing incentives and subsidies from politically powerful energy companies is an unpopular move for many politicians, especially because it tends to result in higher energy prices for consumers.

Instead, politicians in the United States seem to be more comfortable simply evening the playing field for renewable and zero-emissions energy by offering incentives and subsidies to those industries. For example, the US Senate introduced the Offshore Wind Jobs and Opportunity Act last week. The bill will offer federal grants to colleges, governments, unions, and other organizations that will train US workers for offshore wind jobs. If passed, such a fund would lower the costs of training workers for the offshore wind industry.